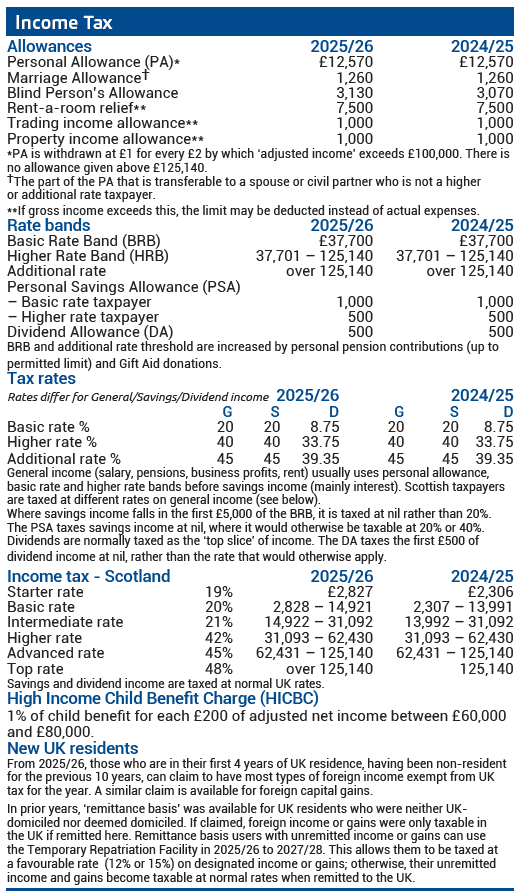

Income Tax Allowances and Rates

Marriage Allowance

Are you married or in a civil partnership? If so you could be entitled to a tax break called the marriage tax allowance, the majority that are entitled to this tax break that are currently missing out.

The marriage tax allowance is where couples either married or in a civil partnership can transfer a proportion of their personal allowance between them. Please see the below criteria and if these all apply to your circumstances then you will be able to apply:

- You’re married or in a civil partnership (just living together doesn’t count).

- One of you needs to be a non-taxpayer, which usually just means earning less than the personal allowance.

- The other one of you needs to be a basic rate taxpayer (couples with a higher or additional-rate taxpayer aren’t eligible for this allowance).

- Both of you must have been born after 6 April 1935

If this applies to your circumstances and you wish to apply please click here to go to the relevant page on the HMRC website and begin the application process. Please note that you will need a form of ID for the non-taxpayer and both of your National Insurance numbers to hand.